Page 26 - Demo

P. 26

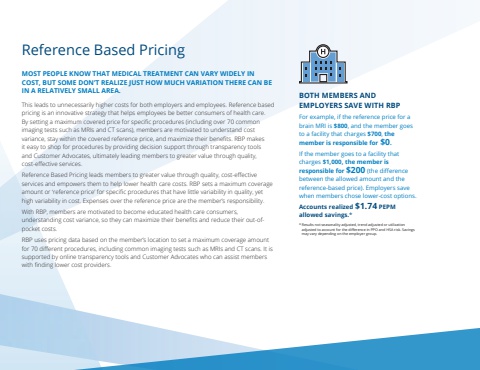

Reference Based PricingMOST PEOPLE KNOW THAT MEDICAL TREATMENT CAN VARY WIDELY IN COST, BUT SOME DON%u2019T REALIZE JUST HOW MUCH VARIATION THERE CAN BE IN A RELATIVELY SMALL AREA. This leads to unnecessarily higher costs for both employers and employees. Reference based pricing is an innovative strategy that helps employees be better consumers of health care. By setting a maximum covered price for specific procedures (including over 70 common imaging tests such as MRIs and CT scans), members are motivated to understand cost variance, stay within the covered reference price, and maximize their benefits. RBP makes it easy to shop for procedures by providing decision support through transparency tools and Customer Advocates, ultimately leading members to greater value through quality, cost-effective services. Reference Based Pricing leads members to greater value through quality, cost-effective services and empowers them to help lower health care costs. RBP sets a maximum coverage amount or %u2018reference price%u2019 for specific procedures that have little variability in quality, yet high variability in cost. Expenses over the reference price are the member%u2019s responsibility.With RBP, members are motivated to become educated health care consumers, understanding cost variance, so they can maximize their benefits and reduce their out-ofpocket costs. RBP uses pricing data based on the member%u2019s location to set a maximum coverage amount for 70 different procedures, including common imaging tests such as MRIs and CT scans. It is supported by online transparency tools and Customer Advocates who can assist members with finding lower cost providers.BOTH MEMBERS AND EMPLOYERS SAVE WITH RBPFor example, if the reference price for a brain MRI is $800, and the member goes to a facility that charges $700, the member is responsible for $0. If the member goes to a facility that charges $1,000, the member is responsible for $200 (the difference between the allowed amount and the reference-based price). Employers save when members chose lower-cost options.Accounts realized $1.74 PEPM allowed savings.** Results not seasonality adjusted, trend adjusted or utilization adjusted to account for the difference in PPO and HSA risk. Savings may vary depending on the employer group.